As a Medicare beneficiary with a Medicare Part D Prescription Drug Plan, you’ll soon receive a critical document in your mail: the Annual Notice of Change (ANOC). Sent by your Medicare Part D plan provider each September, this ANOC letter details specific changes to your prescription drug coverage and costs that will take effect on January 1, 2025.

Important Note for Medicare Supplement (Medigap) beneficiaries: If you primarily have Original Medicare and a Medicare Supplement (Medigap) plan, you generally do not receive an ANOC for your Medigap policy. This is because Medigap plans are standardized by law, and their benefits don’t change annually. However, if you also have a stand-alone Medicare Part D plan to cover your prescription drugs, the ANOC is vital for that coverage.

This article highlights four major factors to review, including:

- Monthly and annual costs for the plan

- Prescription coverage

- Pharmacy networks

- Service areas

Key changes to look for in your Medicare Part D Annual Notice of Change:

1. Changes to your Medicare Part D costs: Premiums, deductibles, and out-of-pocket maximum

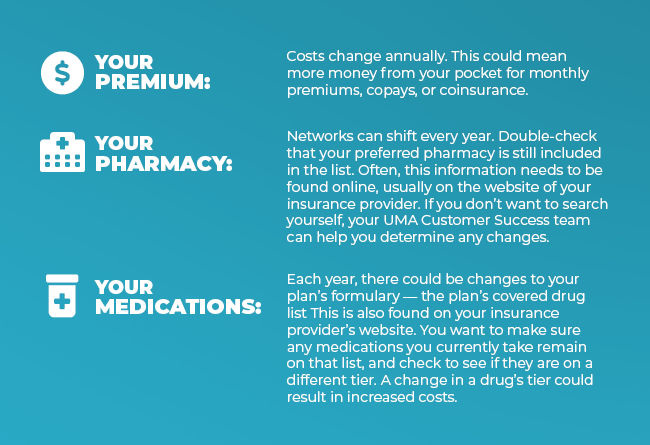

Your Medicare Part D premium (your monthly payment) is often adjusted annually. Your ANOC will clearly state your new monthly premium for 2025.

It’s also crucial to check for changes to your plan’s annual deductible and out-of-pocket maximum. For 2025, there are significant changes to Medicare Part D thanks to the Inflation Reduction Act: the coverage gap (donut hole) is eliminated, and there’s a new $2,000 out-of-pocket cap for covered prescription drugs. Your ANOC will reflect how your plan aligns with these important updates.

If your new Part D premium, deductible, or other out-of-pocket expenses are increasing, or if these changes make your plan less affordable, you may need to compare Medicare Part D plans during Annual Enrollment.

2. Updates to your Medicare Part D prescription coverage (Formulary)

Your Medicare Part D annual notice of change will detail any changes to your plan’s formulary, which is the official list of covered drugs. This is one of the most important sections for many Medicare beneficiaries. Look for:

- Removed Medications: Are any of your essential prescription drugs no longer covered?

- New Medications: Has your doctor prescribed a new medication that is now covered?

- Tier Changes: Have any of your medications moved to a different drug tier? A higher tier usually means higher copayments or coinsurance.

- Restrictions: Check for new requirements like prior authorization or step therapy for certain drugs.

Even if your current medications are still covered, changes to their tier or cost-sharing could significantly impact your out-of-pocket drug costs. If your key prescriptions are no longer affordable or covered, it’s a strong sign to compare Part D plans. (For more detailed information on this topic, download our eBook, The Complete Guide to Medicare Part D).

3. Changes to your Medicare Part D pharmacy network

Your ANOC will also indicate any updates to your plan’s pharmacy network. Make sure your preferred pharmacy is still in-network for 2025. If the pharmacy you use leaves your plan’s network or stops offering preferred cost-sharing, you might pay more for your prescription drugs.

If changing pharmacies isn’t an option for you, consider exploring other Medicare Part D plans that include your preferred pharmacy in their network.

4. Changes to your Medicare Part D plan’s service area

While rare, it’s essential to confirm that your Medicare Part D plan still covers your geographic area, especially if you live in a rural region or are planning a move. Your ANOC will notify you if your plan’s service area has changed for 2025. If your current area is no longer included, you must enroll in a new Part D plan for the upcoming year during the Annual Enrollment Period.

Do you need to take action? Navigating Medicare Annual Enrollment (AEP)

After reviewing your Medicare Part D Annual Notice of Change in conjunction with your personal prescription needs and budget, you’ll have a clear picture of whether your current Part D plan remains the best fit for 2025. Remember, even minor changes to premiums or a single medication’s tier can significantly impact your out-of-pocket costs.

The Medicare Annual Enrollment Period (AEP), running from October 15 to December 7, is your opportunity to switch Medicare Part D plans or enroll in a new one.

Need help making sense of your ANOC or comparing Medicare Part D plans?

- Download The Complete Guide to Medicare Part D

- Contact United Medicare Advisors for unbiased, personalized assistance to help you compare Part D plans from leading carriers and find the best prescription drug coverage for your needs, at no cost to you.